Best Practices and Expectations for Budget Management

To address the projected core budget shortfalls, we are taking some steps to reduce expenses for the remainder of FY24, and then turning to the FY25 budget development process.

We have communicated with campus principal officers about our FY24 expense reduction steps, which include: reducing discretionary spending; shifting core funds spending to non-core funds where possible; conducting further analysis of year-end (carryforward) balances; and proceeding with staff hiring for only the most critically needed positions. Non-core funds (contracts and grants, auxiliaries, sales and service, student fee referenda, miscellaneous fees, etc.) and formal state funded line-items (climate initiative, basic needs, etc.) are not held to these measures.

Budget and Spending Guidance from VC FOA / CFO Ed Reiskin

Think twice before you spend.

Consider whether spending is truly necessary, is it necessary now, and whether it may be a duplication of other expenses in your unit (such as for office supplies, etc).

We have compiled detailed guidance to help you and your team navigate an uncertain budget environment.

Please reach out to ask-bap-group@ucsc.edu with any questions regarding budget practices or spending reductions, and Colette Grey ccgrey@ucsc.edu at Talent and Acquisitions with questions regarding recruitment review.

-

Shift Core funds spending to Non-Core funds where possible

-

Guidelines to Reducing Costs on Core Funds

-

Analyze Carryforward Balances

-

Hire Staff for only the Most Critically Needed Positions

See Related: Our Current Budget Status Page

Shift Core funds spending to Non-Core funds where possible

The following fund codes are currently eligible for permanent budget cut consideration. This list may change as central funds commitments evolve. An up-to-date list will be included on the new campus structural deficit website, currently under development.

|

05397 |

Educational Fund |

|

07427 |

University Opportunity Fund |

|

07429 |

University Opportunity Fund |

|

09523 |

UOF-Regents Research Program |

|

18082 |

Lottery |

|

18083 |

Lottery |

|

18084 |

Lottery |

|

18085 |

Lottery |

|

18086 |

Lottery |

|

18087 |

Lottery |

|

19900 |

General State Appropriations |

|

19917 |

Information Technology |

|

19933 |

General Fund/Federal Overhead |

|

19941 |

CIRM ICR/Other UC Gen Fund Revenue |

|

19942 |

Non-Resident Supplemental Tuition |

|

20000 |

Student Service Fee |

|

20080 |

Course Materials |

|

20086 |

Tuition Academic DFM |

|

20088 |

COVID Student/Employee Testing |

|

20095 |

Tuition |

|

20290 |

Summer Session |

|

20380 |

Summer Revenue Share |

|

53330 |

Central Funds Gift Allocation (a gift fund that is often allocated in lieu of a core fund) |

|

66043 |

Information User |

|

66051 |

Consolidated Business Services |

|

69750 |

Federal C&G Overhead |

|

69900 |

Campus U/R Funds Interest |

Guidelines to Reducing Costs on Core Funds

As we navigate through financial challenges and seek to optimize resource allocation, it's imperative for division, unit and department leaders to uphold exemplary budget management practices and practice cost savings on core funds. These guidelines aim to foster accountability, transparency, and efficiency in financial stewardship across the organization.

Budgeting Practices:

Strategic Alignment: Align division priorities with campus strategic vision that drive outcomes that meet UC Santa Cruz overarching goals.

Consistent Policies: Ensure transparency and better governance of people management, procurement, space allocations, and capital projects.

Internal Review Cycle: Establish an internal budget review process to evaluate needs and prioritize spending before engaging in campus-wide budget discussions.

Long-Term Forecasting: Maintain multi-year forecasts alongside detailed annual budgets, incorporating strategic assumptions for informed decision-making.

Data-Driven Decisions: Utilize relevant metrics to inform budget allocations and adjustments.

Adaptability: Pause programs and redirect efforts in response to funding fluctuations, allowing for strategic reallocation of resources.

Budget Monitoring:

Budget-to-Actual Reviews: Regularly review budget performance to identify potential deficits or unexpected expenses, taking timely corrective actions. Proactive problem solving is encouraged.

Department Accountability: Foster financial accountability at the unit and department level through quarterly expense reviews.

Transparent Reporting: Utilize concise yet detailed management reports to facilitate informed decision-making.

Regular Financial Meetings: Conduct regular financial meetings to address issues proactively and maintain transparency.

Workload Management:

Collaborative Culture: Encourage information sharing and collaboration across units and departments to identify problems and opportunities to enhance efficiency.

Flexibility: Allow flexibility in operations to adapt to changing circumstances and directives.

Utilize Workflow Systems: Implement or adopt digital workflow and issues tracking systems to manage tasks efficiently and collect valuable data for resource allocation decisions.

Overtime: Monitor and reduce the need for overtime work.

Other additional pay such as stipends should be carefully considered. Reasonable STAR awards are allowable.

Process Improvement:

Process improvement respects employee effort and time. Prioritize identifying and eliminating structural barriers within an organization's processes to improve efficiency and productivity to increase overall capacity. The concept can be applied by:

Identifying Waste: The first step is to identify the different types of waste present in the organization's processes. These may include overproduction (non-utilized reporting), excess inventory (underutilized space), waiting time (processing delays), over-processing (excessive approvals), defects (rework), and underutilized talent (develop employee capability). Every process should add value to the final outcome.

Analyzing Root Causes: Once waste is identified, root cause analysis is essential to true problem solving. This involves examining process flows, identifying bottlenecks, and understanding the factors contributing to the problem.

Implementing Solutions: After understanding the root causes, appropriate countermeasures can be implemented to improve processes. This may involve redesigning processes, optimizing workflows, standardizing procedures, and empowering employees to identify and solve problems.

Continuous Improvement: Creating a culture of continuous improvement involves regularly monitoring processes, measuring performance metrics, soliciting feedback from employees and customers, and making further refinements to improve.

Employee Engagement: The active involvement and empowerment of employees at all levels of the organization is essential to success. Employees are encouraged to suggest improvement ideas and participate in implementing solutions.

Position Management and Planning:

Attrition Analysis: Project cost savings opportunities through attrition analysis for effective workforce planning to create opportunities for advancement by analyzing job descriptions and right sizing workloads.

Delayed Recruitment: Delay recruitment of vacant positions strategically to generate one-time savings.

Responsibility Review: Review vacant position responsibilities for potential reallocation or elimination.

Purchasing:

Ensure that all purchases are justified as necessary and reasonable, adhering to standard procurement processes, contracts and controls. Explore opportunities to capitalize on campus or system-wide contracts and bulk purchasing options to drive down costs significantly. Collaborate closely with Strategic Sourcing, recognizing their pivotal role in procurement and cost savings for your department. If additional layers of approval are required for purchases please reach out to fis_probs@ucsc.edu.

Travel and Professional Development:

Strategically minimize non-essential travel. Advance planning enables units to stay within budget parameters and may lead to cost savings. When limiting conference attendance, promote alternative, cost-effective professional development avenues such as internal training initiatives, online courses, and webinars, ensuring equitable access to these opportunities.

Meals and Entertainment:

Exercise restraint in meals and entertainment expenses, limiting or eliminating working meals and other non-essential expenditures. Individual units may implement more stringent meal policies than those outlined in campus guidelines to control costs effectively.

Equipment Management and Budgeting:

Utilize campus resources for procurement including campus and surplus stores. Review equipment management practices and budget allocations. Consider postponing equipment replacement cycles where feasible to optimize resource utilization. Ensure that budgeting accounts for lifecycle equipment replacement and evaluate reserves to address this need adequately. Failure to plan for equipment replacement could pose future financial challenges for the unit.

All Other Expense Types:

Only spend core funds when absolutely necessary.

Culture of Fiscal Responsibility:

By adhering to these best practices and fostering a culture of fiscal responsibility, Divisions can effectively navigate budget challenges while advancing the institution's strategic goals.

Analyze Carryforward Balances

Budget Analysis and Planning (BAP) is in the process of scheduling a financial health meeting with CFO Ed Reiskin for every campus division to discuss future outlook as well as evaluate current funding balances. Please be ready to walk through carryforward balances and commitments at your meeting.

See more on Carryforward Balances Guidelines

Hire Staff for only the Most Critically Needed Positions

Divisional Steps

Principal Officers determine the approval process internal to their division, resulting in a written approval statement that can be submitted to Talent Acquisition via an attachment during the normal job opening request process. This requirement applies to all recruitments where the position being filled is all, or partially, core funded.

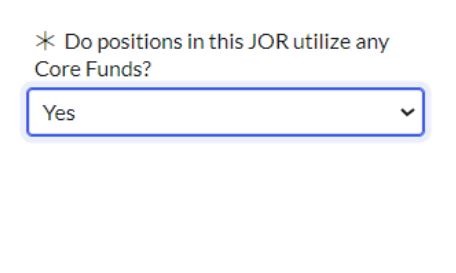

Job opening requests (JOR) are submitted through the ServiceNow ticketing system. The person initiating the request will have 1- 2 new fields to respond to in the usual JOR form. New field number one is required, and identifies whether the salary of the position being filled will use core funds, or not, via a simple pull down Yes/No menu. See screenshot #1:

When “No” is selected, the choice is recorded and the normal workflow to complete the JOR continues as usual.

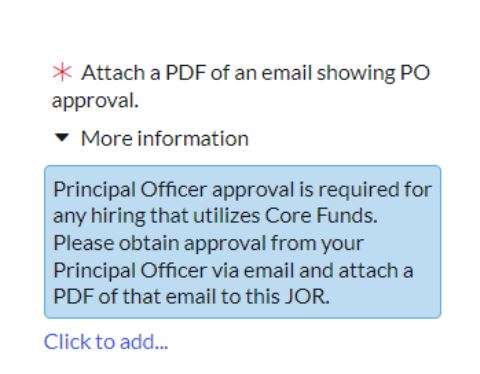

When “Yes” is selected, the second new field appears with instructions to attach the required written PO approval (with a “Click to add” link directly below). The workflow stops if the required attachment is not provided at this step. See screenshot #2:

Talent Acquisition Steps

The Talent Acquisition Consultant (TAC) will review the JOR as per the usual process, and ensure the attachment contains the PO required approval.

Metric

SHR to provide weekly reports to Principal Officers, EVC and Chancellor. Report will include details of the posting, identify if core funded vs non core funded and whether there was approval from the Principal Officer.