Frequently Asked Questions

Answers to the most frequently asked questions are included below. If your question is not answered below, please contact us. Please consult our Who to Contact page and if you still aren't sure who to direct your question to, use BAP's general questions email group: ask-bap-group@ucsc.edu.

See links below, scroll or control-f to search the page.

Budget Related Questions

FOAPAL Related Questions

- What is new in fiscal year 2024 with the Common Chart of Accounts?

- What is a “fund swap” and how can I process one?

- How can I create a new Activity Code?

Assessment or Fee Related Questions

- How is CBR calculated? Is an employee’s status a factor in the benefit assessments applied?

- How is Vacation Leave Accrual Applied?

Transfer Related Questions

- Should I process a TOE or a TOF? (Transfer of Expense or Transfer of Funds/Budget)

- What is the best way to sponsor a program or activity happening on another UC campus?

- How do I pay for services provided by another campus?

- How does another campus pay for services provided by my unit?

- How do I properly account for event cost sharing?

- What is the best way to sponsor a program or activity in another unit?

Other Questions

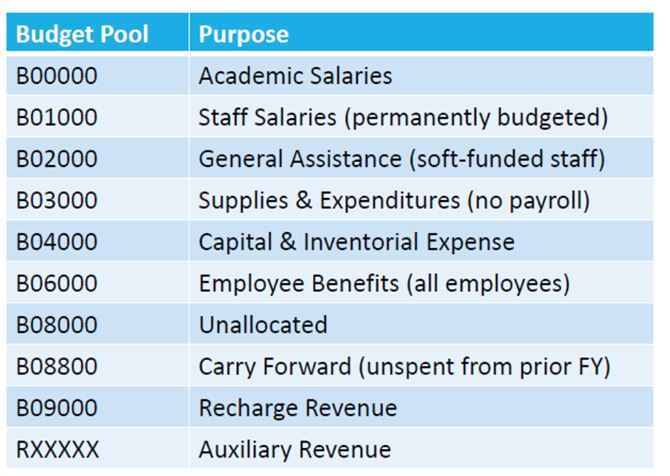

What are the different Budget Pool Accounts?

How do “subs” relate to budget pools?

The Sub Account (used in funding entry in UCPath) will be transformed into a Budget Pool Account Code during general ledger processing.

In UCPath, valid Sub Accounts are 00 (academic), 01 (staff-permanently budgeted), and 02 (non-permanently budgeted staff/ general assistance)

Note: Budget pools are often referred to as “subs” as a common shorthand. Ex. B00000 = “sub zero”

What has changed effective FY24 with the Chart of Accounts?

Effective FY24, UCOP has instituted a Common Chart of Accounts (CCoA) across the UC System, in conjunction with a new UCOP Financial System. One of the changes required by the new UCOP Financial System is that recharge debit/credit balances must net to zero across all recharge accounts. This has required UCSC to create specific account codes to be used for recharge activity, and to create journal voucher edits to ensure that recharge debit/credits stay in balance. Prior to this change, the account used on the debit side of a recharge transaction did not have to be classified as a recharge account; going forward it does.

See: https://financial.ucsc.edu/Pages/FIS_CCOA_Recharge_Accounts.aspx

What is a “fund swap” and how can I process one?

A “Fund Swap” exchanges one fund source for another. For example, you may have a need to reclassify $1,000 in revenue that was subcashiered into an incorrect fund type, into the correct fund type. Or, you may have 19900 funds available but have a need for a less restrictive fund source, so you would like to request a swap of $10,000 in 19900 funds for 69900 funds. In either case, you can present your request to Budget Analysis and Planning (contact Jackie Brummett or Paul Scalisi). Each request is considered on a case by case basis. Fund swaps can only be done between funds of the same group, or between funds that have the same characteristics. For example, a core fund that participates in the central benefits pool, for another core fund that participates in the central benefits pool.

How can I create a new Activity Code?

The FIS User Manual has a guide for establishing activity codes. Be sure to use your unit’s two-digit Alpha Numeric Code at the beginning of the Code. If you are not sure, see the Alpha Numeric Code listing. It is a link embedded in the guide to establishing activity codes linked above.

How is CBR calculated? Is an employee’s status a factor in the benefit assessments applied?

Please see BAP’s CBR webpages for further information on CBR rates. An employee's status as represented, or non-represented, is not a factor in the benefit assessments applied. Benefit assessments are employer paid expenditures.

The CBR Assessment is based on a combination of Employee Class and whether the employee is eligible for full benefits, including UCRP membership, on their PRIMARY Job.

How is Vacation Leave Accrual Applied?

If an employee is eligible to accrue vacation, then the Vacation Leave Accrual (VLA) is charged to the payroll FOAPAL. Vacation accrual is a method by which units or grants are charged for vacation hours as they are earned. See BAP’s VLA webpage for further information. Note, many 9 month academic appointments are not eligible to accrue vacation. Many sponsored awards do not allow VLA to be included in the proposed award budget because the value of vacation taken on the award is credited back to the award. Consult with the Office of Sponsored Projects on whether, or not, to include VLA in sponsored award budgets.

Should I process a TOE or a TOF? (Transfer of Expense or Transfer of Funds/Budget)

I’m re-appropriating resources between orgs: TOF

I’m changing the fund source used for an expense: TOE

I’m sharing expenses across FOAPALs: TOE

I’m applying an activity code to an expense: TOE

I’m budgeting by activity code: TOF

I’m reclassifying an expense: TOE

I’m sponsoring a program, event, employee etc. in another campus unit, or another org: TOF

What is the best way to sponsor a program or activity happening on another UC campus?

If your department is sending or receiving funds to/from another UC Campus, please see the Interlocation Transfer of Funds (ITF) guide found here. If you have any questions regarding the ITF process, please reach out to itf-bap-group@ucsc.edu.

How do I pay for services provided by another campus?

An Intercampus Order or Charge form (IOC), also known as an intercampus recharge, should be initiated by the campus receiving the credit. This standard is followed by all campuses. Your unit should provide a payment FOAPAL to the campus that provided the service. That campus will process an IOC and your unit will receive a debit in a specific IOC transfer account (ex. T0801D). Note, if you need to change the fund, org or activity code associated with the transfer account, you’ll need to reach out to Financial Accounting and Reporting (FAR) for assistance.

How does another campus pay for services provided by my unit?

An Intercampus Order or Charge form (IOC), also known as an intercampus recharge, should be initiated by the campus receiving the credit. This standard is followed by all campuses. To charge another campus for services provided by your unit, your unit will need to process an intercampus recharge (IOC), so the other campus receives the expense and your unit receives recharge revenue (it will land in a specific transfer account associated with B09000 “Recharge Revenue” ex. T0801C ). Note, if you need to change the fund, org or activity code associated with the transfer account, you’ll need to reach out to Financial Accounting and Reporting (FAR) for assistance.

From the Financial Affairs forms directory page, (https://financial.ucsc.edu/Pages/Forms_Directory.aspx ) locate the “Recharges and Journals” category. There you will find both the IOC form and the Intercampus recharge order instructions.

How do I properly account for event cost sharing?

When multiple units are sharing the costs associated with an event (when there is an aggregate of event expenditures to distribute or when the coordinating unit requests contributions prior to incurring event expenditures), the journal voucher rule code class to use is XTOR. The appropriate debit account is X01280, and the appropriate credit account is X06500.

Note: X01280/X06500 are not allowed on Contract and Grant funds.

If the event expenses have already been posted to the ledger, it is best practice to move actual expenses (by their respective account codes) rather than using the cost share account codes for greater transparency (see below).

Remember, using rule codes XTOE or XTOR to process a journal in FIS is not intended to move money, but actual expenses. With few exceptions (such as the event cost shares and approved recharges), Transfers of expense should only be processed when there is a need to take actual incurred expenses that have already posted and make a correction, generally by transferring them to another FOAPAL.

When transferring an expense, the account code the expense originally posted with needs to be the account code used to transfer the expense in the XTOE/XTOR screen on the credit side, and should also be the account code used on the debit side unless the expense is being moved to a more appropriate account code. Expenses can be transferred individually or grouped together if they share the same account code.

See FIS_User_Manual for additional guidance

What is the best way to sponsor a program or activity in another unit?

To sponsor a program or activity that is occurring outside your unit, you should first consider transferring budget in an unrestricted fund source by processing a Transfer of Funds (TOF) If your unit has no unrestricted fund sources available to provide, your unit could incur the program expenses, by transferring the agreed upon expenses originally debited to the other unit, to your unit’s unrestricted FOAPAL of choice. You would process a transfer of expense with rule code XTOE or XTOR to move the agreed upon expenses to your FOAPAL.

It is campus best practice that the unit providing funds, or absorbing the expenses processes the journal voucher in FIS and the unit receiving the funds or the expense credits approves it.

How can I charge a student’s account for a product or service my unit provides?

To charge approved miscellaneous or campus fee(s) to student accounts you must contact the Student Business Services (SBS) team at sbs_analyst-group@ucsc.edu. In the email include:

- Description of what you are charging

- Anticipated number of students to be charged

- When the fee was approved by campus

- FOAPAL where the revenue needs to post

- Must include at least the Fund Org and Revenue/Account code

- All codes must be setup and active in banner prior to sending the email

- 30 character, or less description, of the fee(s), which will appear on the student account and bills

SBS will review for appropriateness and approve or disapprove placement on the student accounts. If approved, instructions on how to set up billing files for upload will be sent or staff will be set up with the ability to directly post to accounts. Units who will be directly posting are required to have one or more staff members with AIS access in order to post/reverse charges. Account posting should not be more than once a month and, if possible, should be posted prior to the billing dates listed on the billing schedule.

Whom should I contact with budget questions not answered here?

Please visit our "Who to Contact" page or contact us at ask-bap-group@ucsc.edu.